|

| Strategic business-Planning grid |

Tl-IE BOSTON CONSULTING GROUP BOX. Using

the Boston Consulting Group (BCG) approach, a company classifies all its SBUs

according to the growth-share matrix shown in Figure 3.3. On the vertical

axis,.market growth rate provides a measure of market attractiveness. On the

horizontal axis, relative market share serves as a measure of company strength

in the market. By dividing the growth-share matrix as indicated, four types of

SBU can be distinguished:

1. Stars.

Stars are high-growth,

high-share businesses or products. They often need heavy investment to finance

their rapid growth. Eventually, their growth will slow down, and they will turn

into cash cows,

2. Cash cows.

Cash cows are low-growth,

high-share businesses or products. These established and successful SBUs need

less investment to hold their market share. Thus they produce cash that the

company uses to pay its bills and to support other SBUs that need investment.

3. Question marks.

Question marks are

low-share businesses united in high-growth markets. They require cash to hold their

share, let alone increase it. Management has to think hard about question marks

- which ones they should build into stars and which ones they should phase out.

4. Dogs.

Dogs are low-growth, low-share

businesses, and products. They may generate enough cash to maintain themselves but do not promise to be large sources of cash.

The ten

circles in the growth-share matrix represent a company's ten current SBAs. The

company has two stars, two cash cows, three question marks, and three dogs. The

areas of die circles are proportional to the SBUs' sales value. This company is

in fair shape, although not in good shape. It wants to invest in the more

promising question marks to make them stars, and to maintain the stars so that

they will become cash cows as their markets mature. Fortunately, it has two

good-sized mesh cows whose income helps finance the company's question marks,

stars, and dogs. The company should take some decisive action concerning its

dogs and their question marks. The picture would be worse if the company had no

stars, had too many dogs, or had only one weak cash cow. Once it has

classified its SBUs, the company must determine what role each will play in the

future. There are four alternative strategies for each SBU. The company can

invest more in the business unit to build its share. It can invest just enough

to hold the SBU's share at the current level. It can harvest the SBU, milking

its short-term cash flow regardless of the long-term effect. Finally, the

company can divest the SBU by selling it or phasing it out and using the

resources elsewhere. As time passes, SBUs change their positions in the

growth-share matrix. Each SBU has a life cycle. Many SBUs start out as question

marks and move into the star category if they succeed. They later become cash

cows as market growth falls, then finally die off or turn into dogs toward the

end of their life cycle. The company needs to add new products and units

continuously, so that some of them will become stars and, eventually, cash cows

that will help finance other SBUs.

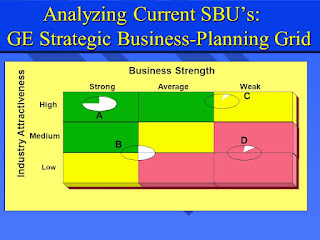

THE GENERAL ELECTRIC GRID. General Electric introduced a comprehensive portfolio planning tool called a strategic business-planning grid (see Figure 3.4). It is similar to Shell's directional policy matrix. Like the BCG approach, it uses a matrix with two dimensions - one representing industry attractiveness (the vertical axis) and one representing company strength in the industry (the horizontal axis). The best businesses are those located in highly attractive industries where the company has high business strength. The GE approach considers many factors besides market growth rate as part of industry attretctifBeness, It uses an industry attractiveness index made up of market size, market growth rate, industry profit margin, amount of competition, seasonal and cycle of demand, and industry cost structure. Each of these factors is rated and combined in an index of industry attractiveness. For our purposes, an industry's attractiveness is high, medium, or low. As an example, the Kraft subsidiary of Philip Morris has identified numerous highly attractive industries - natural foods, specialty frozen foods, physical fitness products, and others.

The grid has three zones. The green cells in the upper left include the strong SBUs in which the company should invest and grow. The beige diagonal cells contain SRUs that are medium in overall attractiveness. The company should maintain its level of investment in these SRUs. The three mauve cells at the lower right indicate SBUs that are low in overall attractiveness. The company should give serious thought to harvesting or divesting these SRUs. The circles represent their company SBUs; the areas of the circles are proportional to the relative sizes of the industries in which these SRUs compete. The pie slices within the circles represent each SBU's market share. Thus circle A represents a company SRU with a 75 percent market share in a good-sized, highly attractive industry in which the company has strong business strength. Circle B represents an SRU that has a 50 percent market share, but the industry is not very attractive. (Circles C and D represent two other company SBUs in industries where the company has small market shares and not much business strength. Altogether, the company should build A, maintain B, and make some hard decisions on what to do with G and D. Management would also plot the projected positions of the SBUs with and without changes in strategies. By comparing current and projected business grids, management can identify the primary strategic issues and opportunities it faces.

The 'famous five failure contrasts with

Erainet, a focused French company that is the world's biggest producer of

Ferro-risked and high-speed steels. They owe their number one position to

their decision to invest their profits in a 'second leg' that would be a

logical industrial and geographical diversification for them. They bought

French Commentryene and Swedish Kloster Speedsteel. They quickly integrated

them and, according to Yves Rambert, their chairman, and chief executive, 'found

that the French and the Swedes can work together. The unified international

marketing team is doing better than when the companies were separate. Aramco

is now looking for a 'third industrial leg' that will have customers and

technologies with which the group's management is familiar but does not

compete for their present customers.

• Problems with Matrix Approaches

The BCG, GE, Shell, and other formal methods revolutionized strategic planning. However, such approaches have limitations. They can be difficult, time-consuming, and costly to implement. Management may find it difficult to define SBUs and measure market share and growth. In addition, these approaches focus on classifying current businesses but provide little advice for future planning. Management must still rely on its judgment to set the business objectives for each SBU, determine what resources to give to each, and work out which new businesses to add. Formal planning approaches can also lead the company to place too much emphasis on market-share growth or growth through entry into attractive new markets. Using these approaches, many companies plunged into unrelated and new high-growth businesses that they did not know how to manage - with very bad results. At the same time, these companies were often too quick to abandon, sell, or milk to death their healthy, mature businesses.

Developing Growth Strategies

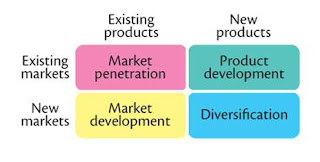

The product/market expansion

grid,'"shown in Figure 3.5, is a useful device for identifying growth

opportunities. This shows four routes to growth: market development, new

markets, new products, and diversification. We use the grid to explain how

Mercedes-Benz, the luxury ear division of the German Daimler-Benz industrial group,

hoped for a return to profits after its DM1.8hn loss in 1993."

MARKET PENETRATION.

The new C-class model (replacing the

aging 190) helped the company increase its sales by 23 percent in 1994. Sales

were up 40 percent in Western Europe (excluding Germany), 34 percent in the

United States, and 30 percent in Japan. In Germany, the 38 percent growth gave

a 2 percent rise in market share.

MARKET DEVELOPMENT.

Its original 190 launched Mercedes into

the executive saloon market for the first time. With its A-series, an 'even

smaller car' produced at Rastatt, Mercedes will enter the family saloon market.

German reunification gave the company an immediate sales boost. In Eastern

Europe and China, the brand's image and reputation for reliability and quality

have made it the transport for the newly rich.

DIVERSIFICATION.

Diversification is an option taken by Mercedes' parent company Daimler-Renz, It has rapidly moved into aerospace by buying Dornier, Motoren Turbinen Union (MTU), and a 51 percent stake in Messerschmitt Boelkow-BIohm (MBB). Its newer Deutsche Aerospace (DASA) is now Germany's biggest aerospace and defense group. The motives behind the strategy were to offset stagnating vehicle sales and to use high technology from the acquisitions of cars and trucks. Like many other firms, Daimler-Benz is finding diversification a difficult route. Shortly after consolidating the acquisitions, the 'peace dividend' damaged the defense sector and the international airline industry was in recession. Observers now question the logic of the acquisitions and doubt whether even a company with Daimler's management and financial strength can handle such a radical diversification

Marketing Within Strategic Planning

Planning Functional Strategies

The company's strategic plan establishes

what kinds of business the company will be in and its objectives for each.

Then, within each business unit, more detailed planning takes place. The main

functional departments in each unit - marketing, finance, accounting, buying,

manufacturing, personnel, and others - must work together to accomplish

strategic objectives. Each functional department deals with different publics

to obtain resources such as cash, labor, raw materials, research ideas, and

manufacturing processes, For example, marketing brings in revenues by

negotiating exchanges with consumers. Finance arranges exchanges with lenders

and stockholders to obtain cash. Thus the marketing and finance departments

must work together to obtain needed funds. Similarly, the personnel department

supplies labor, and the buying department obtains materials needed for

operations and manufacturing.

|

| Strategic business-Planning grid |

Marketing's Role in Strategic Planning

There is much

overlap between the overall company strategy and marketing strategy. Marketing

looks at consumer needs and the company's ability to satisfy them; these

factors guide the company's mission and objectives. Most company strategic

planning deals with marketing variables - market share, market development, and growth - and it is sometimes hard to separate strategic planning from marketing

planning. Some companies refer to their strategic planning as 'strategic

marketing planning'. Marketing plays a key role in the company's strategic

planning in several ways. First, marketing provides a guiding philosophy -

company strategy should revolve around serving the needs of important consumer

groups. Second, marketing provides inputs to strategic planners by helping to

identify attractive market opportunities and by assessing the firm's potential

to take advantage of them. Finally, within individual business units, marketing

designs strategies for reaching the unit's objectives. Within each business

unit, marketing management determines how to help achieve strategic objectives.

Some marketing managers will find that their objective is not to build sales.

Rather, it may be to hold existing sales with a smaller marketing budget or

even to reduce demand. Thus marketing management must manage demand to the

level decided upon by the strategic planning prepared at headquarters.

Marketing helps to assess each business unit's potential, set objectives for it, and then achieve those objectives.

Marketing and the Other Business Functions

In some firms, marketing is just another

function - all functions count in the company and none takes leadership. On the

other extreme, some marketers claim that marketing is the principal function of

the firm. They quote Drucker's statement: 'The aim of the business is to create

customers.' They say it is marketing's job to define the company's mission,

products, and markets, and to direct the other functions in the task of serving

customers. More enlightened marketers prefer to put the customer at the center

of the company. These marketers argue that the firm cannot succeed without

customers, so the crucial task is to attract and hold them. Customers are

attracted by promises and held by satisfaction. Marketing defines the promise

and ensures its delivery. However, because actual consumer satisfaction is

affected by the performance of other departments, all functions should work

together to sense, serve, and satisfy customer needs. Marketing plays an

integrative role in ensuring that all departments work together toward

consumer satisfaction,

Conflict Between Departments

Each business function has a different view of which publics and activities are most important. Manufacturing focuses on suppliers and production; finance addresses stockholders and sound investment; marketing emphasizes consumers and products, pricing, promotion, and distribution. Ideally, all the different functions should blend to achieve consumer satisfaction. In practice, departmental relations are full of conflicts and misunderstandings. The marketing department takes the consumer's point of view. But when marketing tries to develop customer satisfaction, it often causes other departments to do a poorer job on their terms. Marketing department actions can increase buying costs, disrupt production schedules, increase inventories, and create budget headaches. Thus the other departments may resist bending their efforts to the will of the marketing department. Despite the resistance, marketers must get all departments to 'think consumer' and to put the consumer at the center of company activity.

|

| Strategic business-Planning grid |

The customer-focus program has since extended to all its operations. It encourages people in all its 5,000-plus profit centers to 'think customer', track customer satisfaction, and find ways to continually improve customer service. The company keeps 'close to the customer' through extreme decentralization and a flat, team-driven organization. Sune Karlsson, who is responsible for the customer focus program, says: 'The people in our many small groups are close to the customer, are more sensitive to their needs, and are more able to respond to those needs. The role of keeping the customer satisfied and happy is not just the role of marketing people. Employees work together to develop a system of functional plans and then use cross-border coordination to accomplish the company's overall objectives. Furthermore, Karlsson suggests, 'We have learned that the customer focus program reduces the optimal size of an operation (that is, improves efficiency). It ensures that the customer is better served and brings us closer to the ultimate goal of partnering (that is, long-term relationships)

Would your

friends would be interested? Share this story!

( Keywords )

إرسال تعليق